Global Stock Markets Crash as U.S. Tariff Surge Sparks Widespread Panic

- Business

- April 7, 2025

- No Comment

Global Stock Markets Crash as U.S. Tariff Surge Sparks Widespread Panic

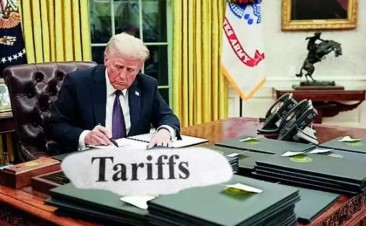

Global stock markets suffered historic losses on Monday following the United States’ abrupt implementation of sweeping tariffs, triggering a wave of panic selling across Asia, Europe, and South Asia. The tariff escalation, championed by U.S. President Donald Trump, has reignited fears of a prolonged global trade war.

Asian Markets Lead Global Collapse

Asian stock exchanges bore the brunt of the market meltdown. Japan’s Nikkei 225 index fell 7.9%, while the Topix index dropped 7.7%. In Hong Kong, the Hang Seng Index plunged nearly 12%, marking one of its worst trading days in years. Major technology companies, including Alibaba and Tencent, saw double-digit losses, with Alibaba down 14% and Tencent losing over 10%.

Chinese investors reacted strongly after returning from a public holiday, sending the Shanghai Composite Index down more than 7% and the CSI300 index to a similar low.

Europe Opens to Sharp Losses

European markets opened with steep declines, reflecting the global ripple effect. Germany’s DAX index fell over 9%, and the FTSE 100 in London dropped nearly 5% in early trading. Market analysts cite growing investor anxiety over trade instability, recession risks, and market volatility.

Pakistan Stock Exchange Suffers Unprecedented Drop

The Pakistan Stock Exchange (PSX) witnessed a record-breaking selloff. The KSE-100 Index plunged 3,297 points at the opening bell, falling to 115,499. The sharp decline triggered an automatic trading halt. After trading resumed, the index continued to plummet, eventually dropping 8,000+ points to close at 110,335, its lowest in months.

This massive drop followed last week’s volatility, where the market briefly surged past 120,000 points, only to reverse course dramatically by week’s end.

Wall Street Futures Signal Continued Turbulence

U.S. stock futures are trending downward ahead of the opening bell, following last week’s two-day selloff that erased over $5 trillion in market value. The Trump administration’s announcement of higher tariffs, met with a 34% counter-tariff by China, has significantly worsened global investor sentiment.

Global Economic Outlook Uncertain

Economists and financial experts are warning of a potentially deep economic downturn if tensions between the U.S. and its trading partners continue to escalate. Central banks and international financial institutions have urged restraint and cooperation to stabilize global markets.