China and Egypt Strengthen Financial Ties with Local Currency Settlement Deal

- Business

- July 11, 2025

- No Comment

Report by “Safarti Tarjuman” International News Desk

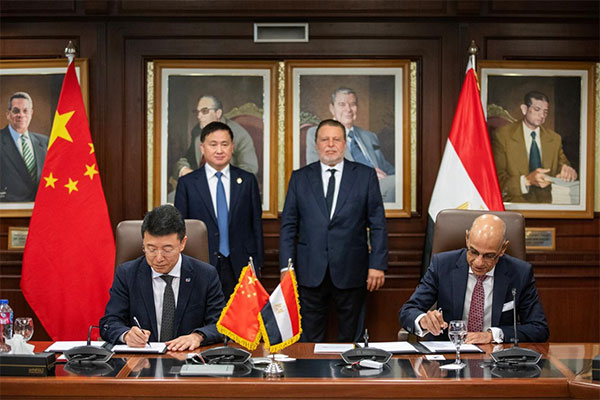

Cairo — China and Egypt have taken a significant step toward deepening financial integration by signing a Memorandum of Understanding (MoU) that promotes trade and investment settlements in local currencies, the Chinese central bank announced Friday.

The agreement was signed during Chinese Premier Li Qiang’s official visit to Cairo, where he met with Egyptian Prime Minister Mostafa Kamal Madbouly to discuss expanding bilateral cooperation.

The MoU aims to reduce reliance on the US dollar by enabling settlement of transactions in Egyptian pounds and Chinese yuan, reinforcing both nations’ commitment to financial sovereignty and diversified trade.

The pact also outlines closer collaboration between the People’s Bank of China (PBoC) and the Central Bank of Egypt, with plans to enhance coordination on interest rate management, digital finance, and cross-border payment systems.

Premier Li emphasized the shared goal of advancing economic cooperation in areas such as:

- Digital innovation

- Green energy

- Artificial intelligence (AI)

- Electric vehicles

- New infrastructure investment

In a separate high-level meeting, PBoC Governor Pan Gongsheng met with Egyptian Central Bank Governor Hassan Abdullah. Pan commended the “positive momentum” in bilateral trade growth and emphasized the need to:

- Expand currency swap agreements

- Improve cross-border financial infrastructure

- Foster joint investments in fintech and financial markets

Both leaders endorsed the idea of facilitating the mutual establishment of financial institutions, laying the groundwork for stronger long-term collaboration.

This local currency settlement agreement aligns with China’s broader Belt and Road Initiative (BRI) and Egypt’s efforts to boost regional financial autonomy. By reducing dependence on foreign currencies, the deal is expected to:

- Lower transaction costs

- Mitigate exchange rate risks

- Enhance trust between financial institutions

China and Egypt also plan to cooperate on central bank digital currencies (CBDCs) and next-generation payment technologies, supporting innovation in the global financial architecture.

Thank you for reading! For comprehensive news coverage and exclusive stories, visit SafartiTarjuman.com