Pakistan Unveils Rs17.573 Trillion Federal Budget for FY2025-26

- Business

- June 10, 2025

- No Comment

ISLAMABAD – Pakistan’s federal government has announced a record Rs17.573 trillion budget for the fiscal year 2025-26, with sweeping reforms, significant tax relief for salaried individuals, and increased allocations for defense and debt servicing.

Key Budget Highlights:

- Total Budget: Rs17.573 trillion

- Fiscal Deficit: Rs6.501 trillion

- Debt Servicing Allocation: Rs8.207 trillion

- Defense Budget: Rs2.550 trillion

Salary and Pension Increases Announced

The government has proposed a 10% increase in salaries for government employees and a 7% rise in pensions. Employees from Grade 1 to 16 are also expected to receive a 30% disparity allowance, addressing long-standing pay gap concerns.

Major Income Tax Relief for Salaried Class

To ease financial pressure on salaried citizens, the government has introduced new tax brackets:

- Annual income between Rs600,000 and Rs1.2 million will now be taxed at just 1%, down from 5%.

- For income up to Rs2.2 million annually, the rate is reduced from 15% to 11%.

- An employee earning Rs1.2 million per year will now pay Rs6,000 in tax instead of Rs30,000.

Disruptive Budget Session

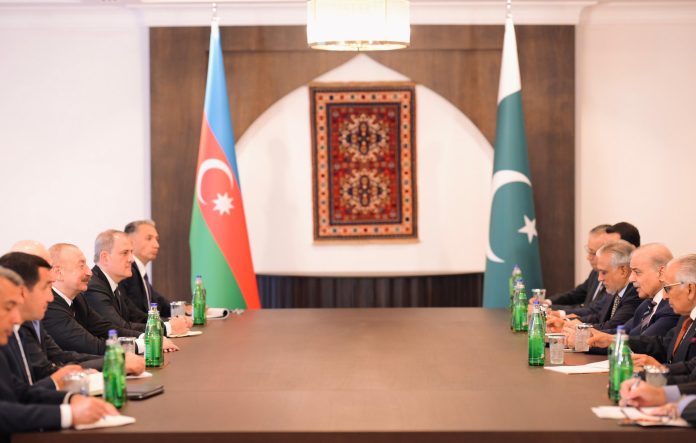

The budget session in the National Assembly began 30 minutes late and witnessed strong protests by opposition lawmakers. Amid slogan chanting and document tearing, Prime Minister Shehbaz Sharif remained present as PML-N members shielded him from the disruption.

Finance Minister’s Address

Presenting the budget, Finance Minister Muhammad Aurangzeb credited coalition leaders including Nawaz Sharif and Bilawal Bhutto Zardari for their support. He also saluted the Pakistan Armed Forces for defending national sovereignty and acknowledged public resilience.

Economic Recovery and Growth Indicators

Aurangzeb highlighted several key achievements:

- Business Confidence Index has improved significantly.

- Inflation has dropped from 29.2% to 4.7%.

- Pakistani rupee remains stable.

- Remittances reached $31.2 billion, projected to climb to $38 billion.

- A current account surplus of $1.5 billion is expected.

- Fitch Ratings has upgraded Pakistan’s credit outlook.

AI-Driven Tax Reform and Digital Tracking

The government is introducing an AI-based taxation system to improve compliance and reduce evasion:

- Cement, fertilizer, beverage, and textile sectors will be monitored via digital production tracking.

- Rs9.8 billion in fraudulent refund claims were recently blocked.

- A simplified tax return form requiring only 7 fields will be launched on July 1.

- Over 390,000 non-filers have been identified for enforcement.

Privatization and Fiscal Consolidation Plans

The upcoming fiscal year will prioritize restructuring and privatization:

- PIA and Roosevelt Hotel are slated for privatization.

- 45 state-owned enterprises will be restructured, privatized, or closed.

- Rs3 trillion in savings expected from renegotiated Independent Power Producer (IPP) contracts.

Reko Diq: A National Asset

The Reko Diq project is expected to generate over $75 billion in revenue:

- Construction will create more than 41,500 jobs.

- Feasibility study completed in January 2025, fast-tracking project development.

Customs and Tariff Policy Overhaul

- A new National Tariff Policy (2025-2030) will phase out additional customs duties within four years and regulatory duties within five years.

- New customs duty brackets will range from 5% to 15%.

- Debt-to-GDP ratio has improved from 74% to 70%.

FATA/PATA Tax Exemption Removed

Tax exemptions for FATA and PATA have been withdrawn.

Boosting IT and SMEs

- IT exports have hit $3.1 billion in 10 months, with a five-year goal of $25 billion.

- A national SME support framework will be introduced, including a steering committee and business plan.

- Digital governance and cybersecurity will remain key focus areas.

- Thank you for reading! For comprehensive news coverage and exclusive stories, visit SafartiTarjuman.com