US Stock Markets Sink After Trump’s Tariff Announcement

- Business

- April 3, 2025

- No Comment

US Stock Markets Sink After Trump’s Tariff Announcement

U.S. stock markets suffered significant declines on Thursday after former President Donald Trump introduced sweeping tariffs on the country’s largest trading partners, triggering immediate uncertainty among investors.

At the start of the day, all major U.S. indices experienced a sharp downturn. The Nasdaq Composite dropped by 4.5%, while both the S&P 500 and Dow Jones Industrial Average fell by 3.4% and 2.7%, respectively. By midday, tech giants such as Apple and Nvidia saw a combined loss of around $470 billion in market value.

The U.S. dollar also took a significant hit, declining by 2.2% against other major currencies, reaching its lowest point in six months.

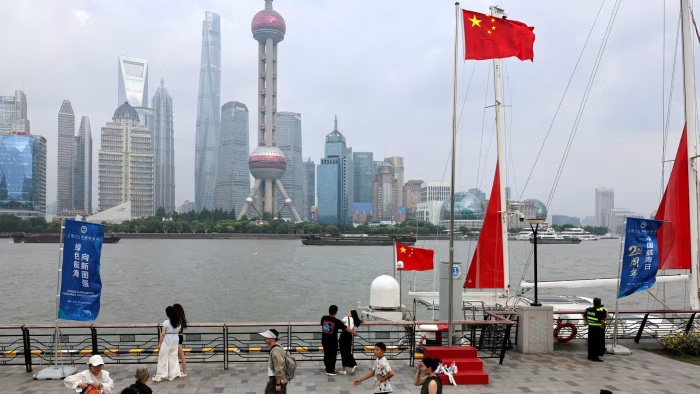

Trump’s tariff plan, which includes a 10% base tariff starting April 5, followed by reciprocal tariffs beginning April 9, has left markets uncertain about the potential economic impact. Several of the U.S.’s key trading partners, including China, the European Union, Japan, and Taiwan, are targeted with these new duties, with some facing tariffs exceeding 20%.

Despite warnings from economic analysts about the risks these tariffs pose to the U.S. economy, including higher consumer prices and trade disruptions, Trump remains resolute. He tweeted: “THE OPERATION IS OVER! THE PATIENT LIVED, AND IS HEALING.

In a public speech, Trump expressed confidence that the tariffs would mark the beginning of a new “golden age” for the country, promising economic prosperity and wealth.

Commerce Secretary Howard Lutnick reinforced Trump’s stance, insisting that the President would not back down from his position on tariffs. “This is the right move for America, and we are not turning back,” Lutnick said during a CNN interview.

However, the announcement has sparked widespread opposition from business leaders. The Business Roundtable, a group representing top U.S. corporations like JP Morgan, Apple, and IBM, urged the White House to reconsider, warning that these tariffs could harm American businesses and consumers. “These tariffs could damage U.S. manufacturers, jobs, and exporters, potentially leading to higher prices for American consumers,” the group stated.

The National Retail Federation expressed similar concerns, arguing that increased tariffs would create uncertainty and economic stress for retailers and consumers alike. The business environment is already challenging, and these new measures will only make it harder,” the federation said in a statement.

Polls indicate that American public opinion is divided, with only 28% supporting tariffs, while 58% believe they will harm the economy. Despite this, Trump remains determined to press ahead, framing the tariffs as a necessary step to protect U.S. interests and restore economic strength.

The immediate effects on the stock market and the broader economy are yet to be fully realized, but concerns continue to grow about the longer-term consequences of Trump’s tariff strategy.